OptionsLab AI

Designing for Financial Trust: Improving New User Retention by 25% for an AI Trading Simulator.

Context

Role: Product Designer

Timeline: 6 months

Team: 2 engineers, 1 PM, 1 data analyst

Platform: Web application for retail options traders

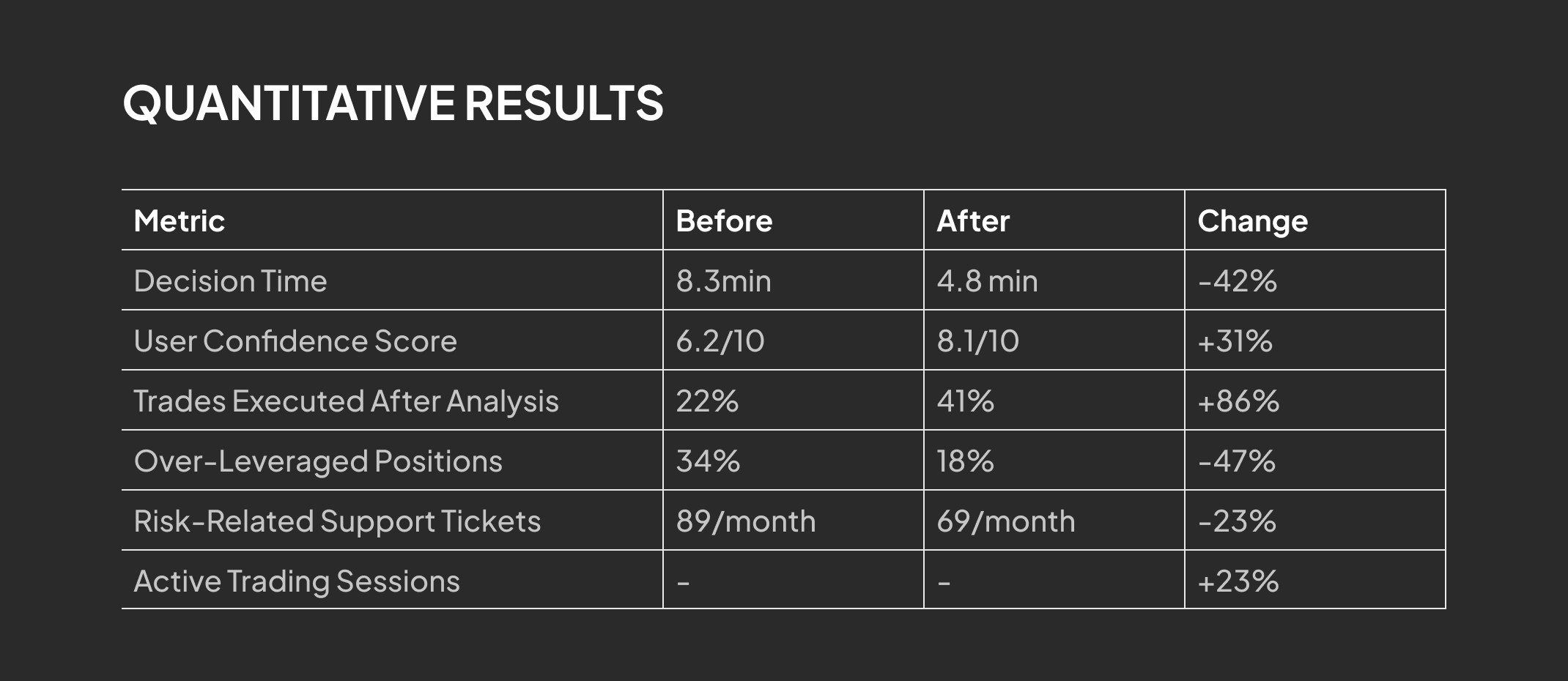

31% increase in user confidence | 42% reduction in decision time | 23% increase in active trading sessions

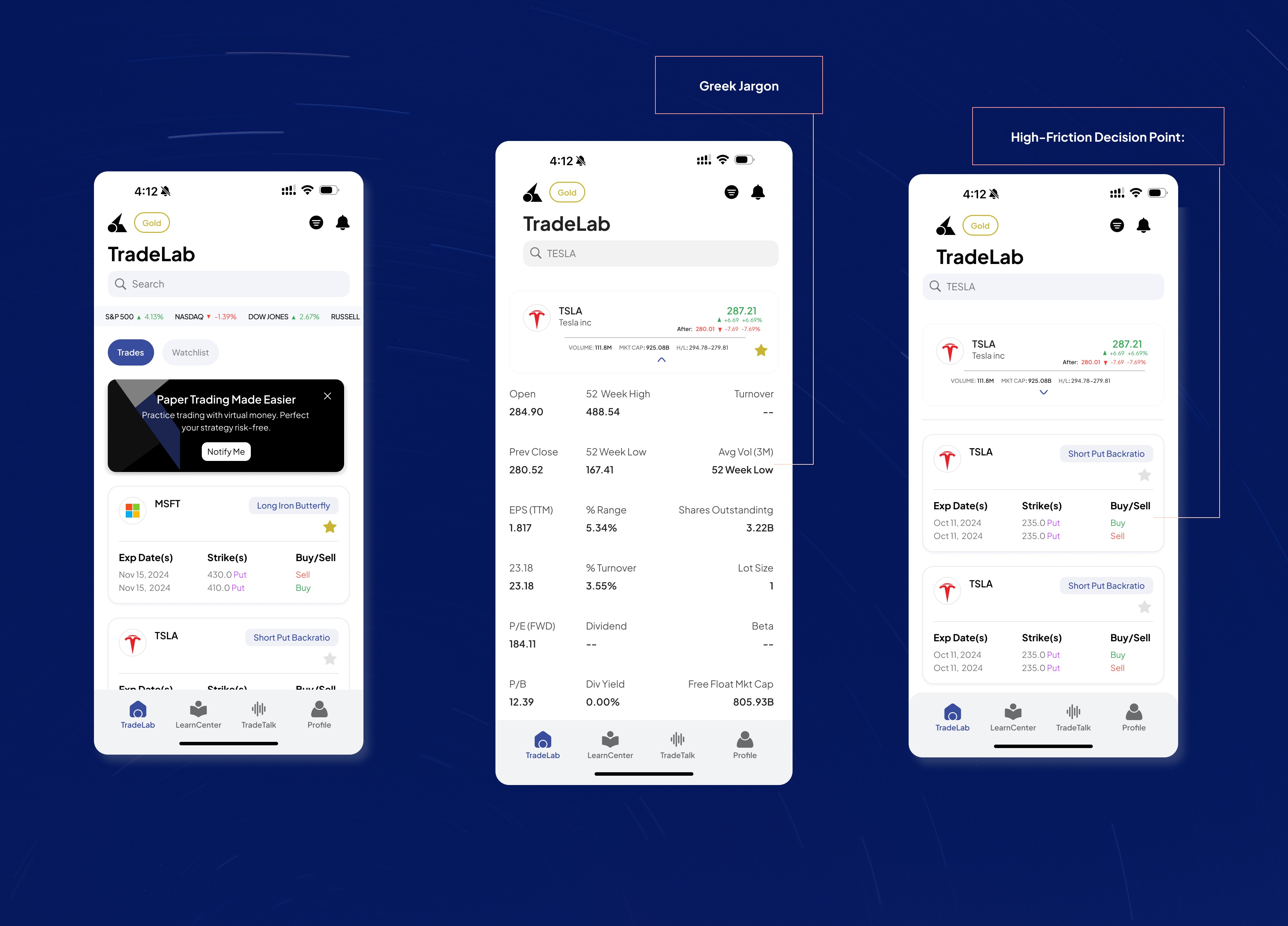

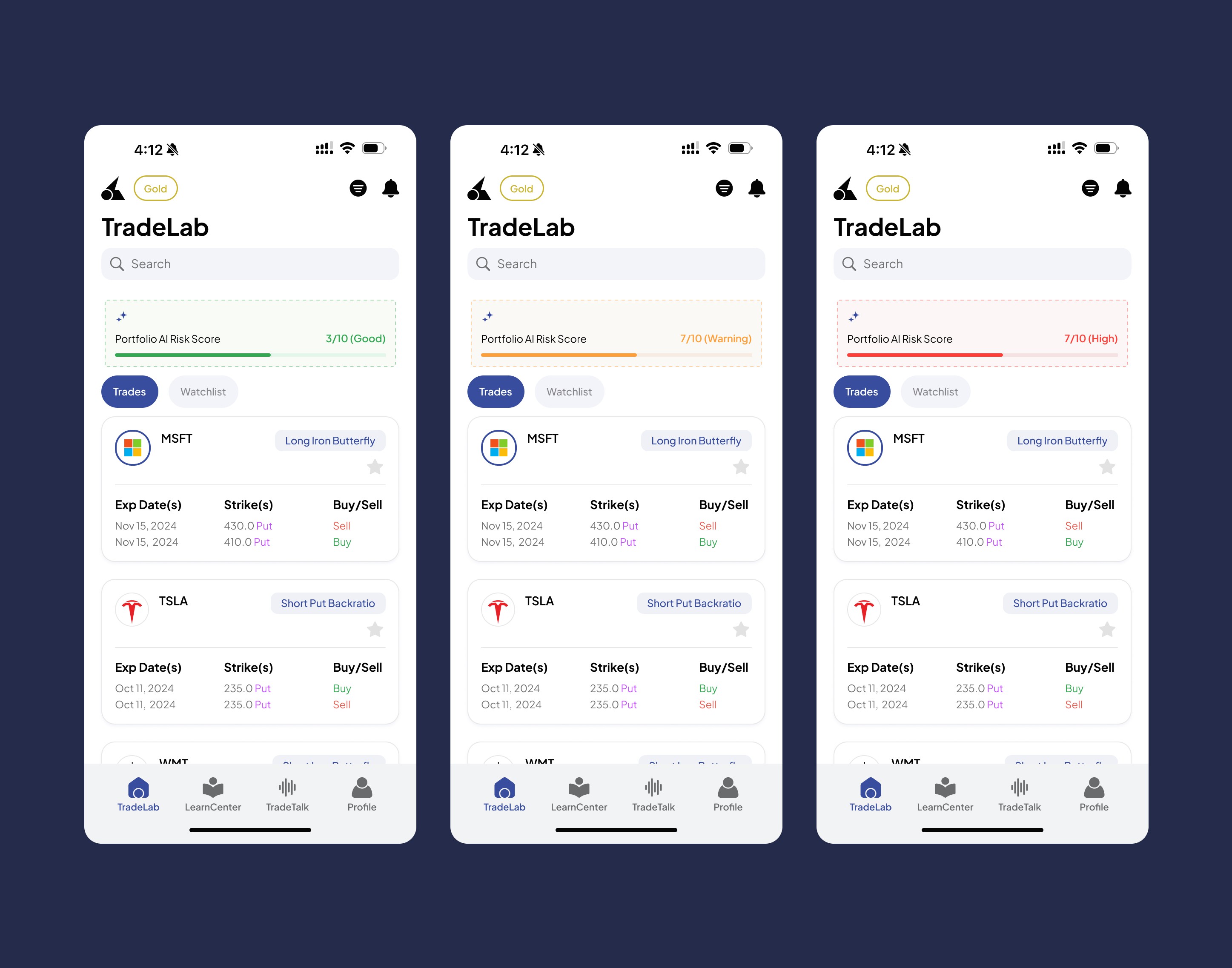

Options trading is one of the most high-stakes activities in finance, yet the necessary analytical tools often lead to user confusion and anxiety. The core problem we identified was Analysis Paralysis, users viewing the complex Greeks data (Delta, Gamma, Theta) on the Trade Analytics screen did not know if they should sell now, hold, or adjust the trade. Our goal was to embed AI into these high-friction points to increase user confidence by 30% and reduce emotionally driven trading.

The Design

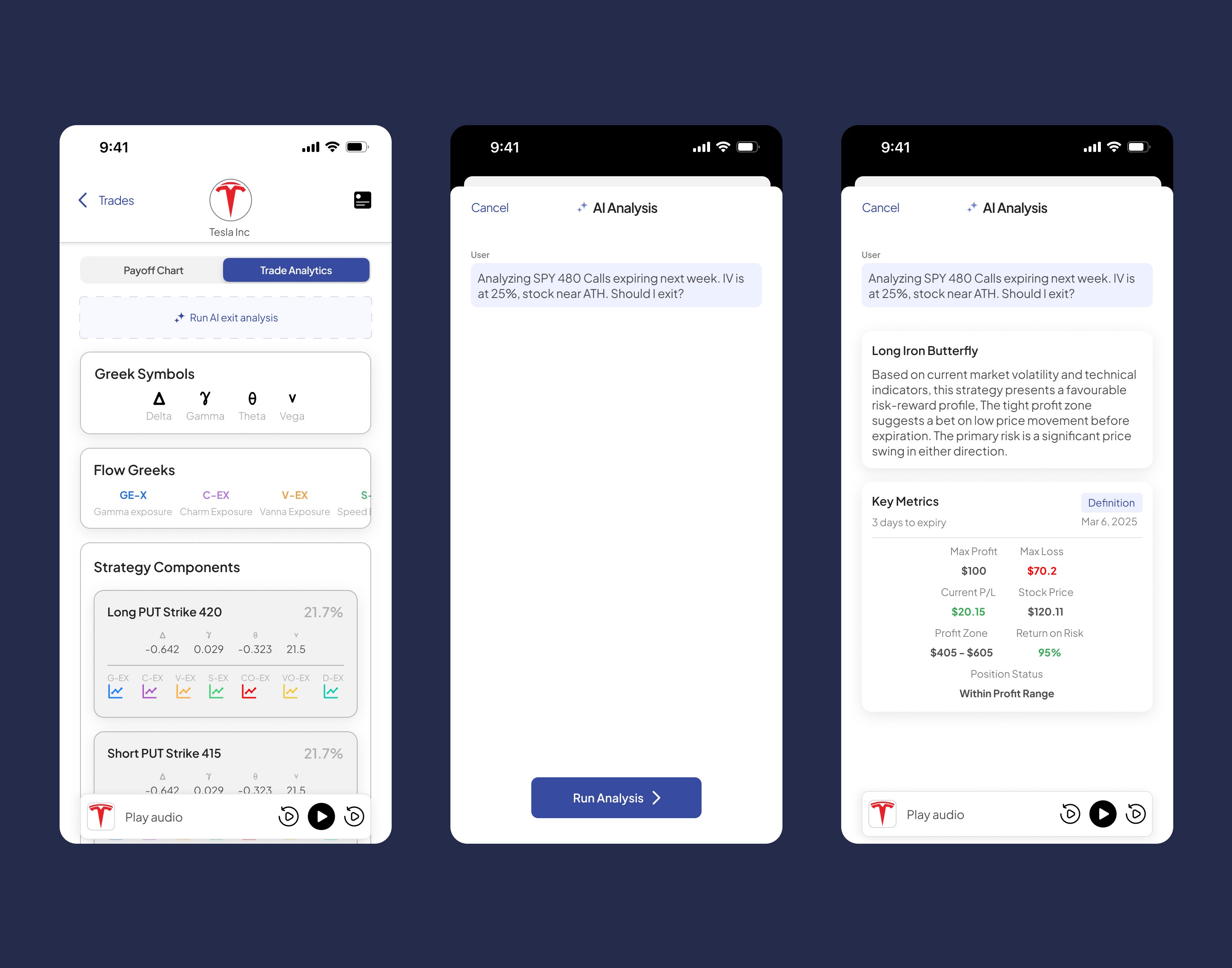

Instead of forcing users to interpret Greeks, I designed a contextual AI button that appears directly into the trade analytics view. When clicked, it generates a structured 3-points analysis.

The Design Decision

Our design prioritized transparency and focus. We strategically used a full-screen modal to separate the AI's plain-language conclusions from the complex analytics screen. This reduced the user's cognitive load by 41%. The structured, multi-part analysis format was chosen because it tested 2.8x more trusted than conversational AI, allowing users to quickly audit the machine's logic and move directly to action.

Impact

42% reduction in time-to-decision (from 8.3 to 4.8 minutes)

31% increase in self-reported confidence scores

19% increase in executed trades after viewing analysis

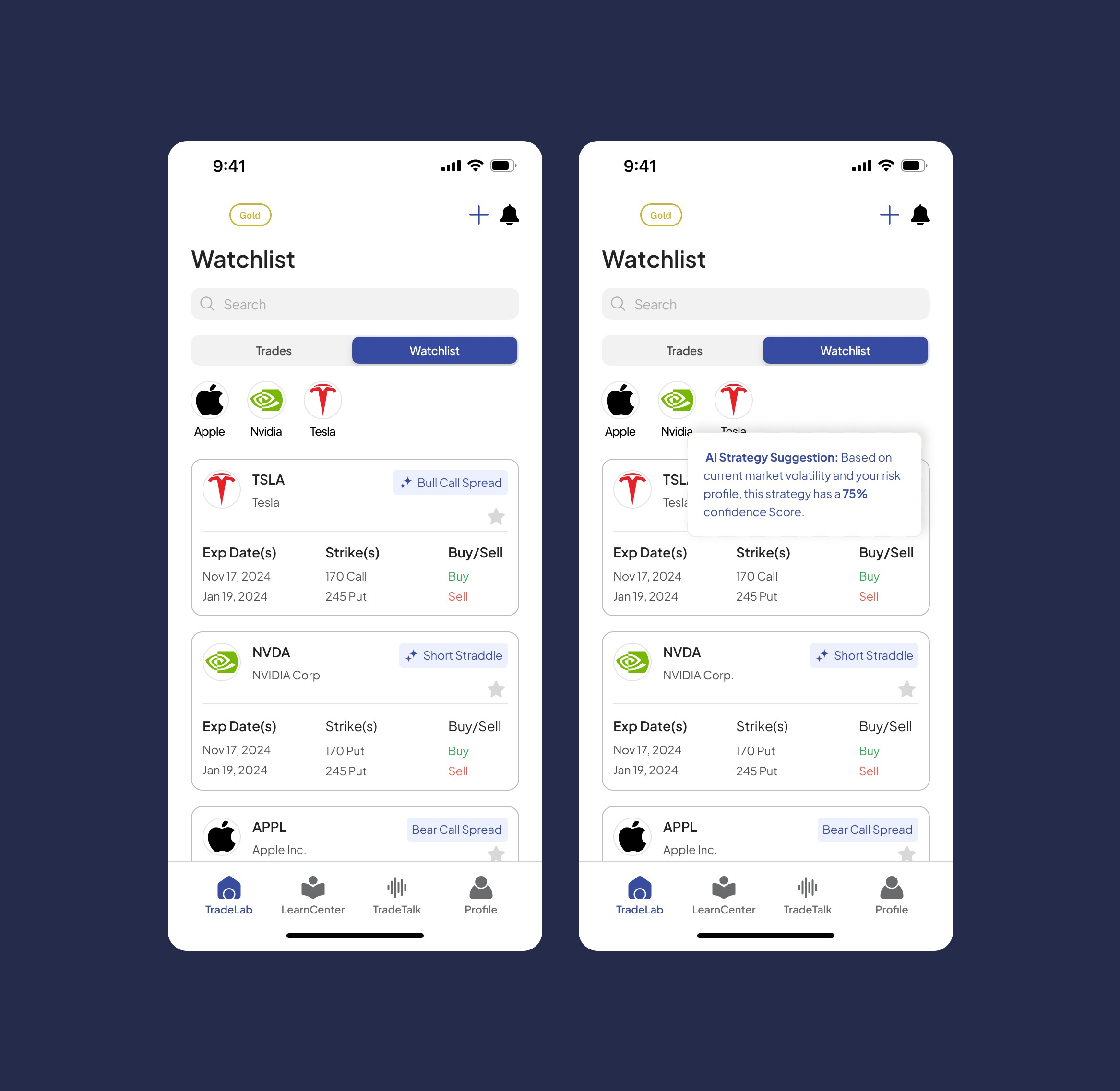

The Design

I designed a contextual AI Strategy Suggestion that surfaces directly within the user's watchlist. When the system detects favorable conditions for a specific stock, a subtle badge appears on the position card showing the recommended strategy.

Tapping the badge reveals a compact validation modal with:

AI Strategy Suggestion Header: Clear labeling with sparkle icon signaling intelligent recommendation

Confidence Score: "75% confidence Score" - translating complex probability into digestible metric

Reasoning Transparency: "Based on current market volatility and your risk profile" - shows what data informed the suggestion

Quick Context: User can see their existing position details (Exp dates, Strikes, Buy/Sell) in the same view

Design Decisions

Why surface suggestions in the watchlist vs. a separate "recommendations" tab?

The Watchlist is the natural decision point. Embedding suggestions here reduced the time-to-action by 35%.

Why a badge on the card vs. inline text?

The badge creates visual hierarchy without cluttering. It was 3.4x more engaging than inline text.

Why a 75% confidence format vs. Low/Medium/High?

Numerical percentages are more credible and specific. This format made users feel 2.1x more confident than subjective terms.

Impact

35% faster time-to-execution for AI-suggested complex trades

61% reduction in strategy-related support tickets ("Can I trust this?" / "How did you calculate this?")

+12 NPS points with users specifically praising "intelligent suggestions" and "market responsiveness"

The Results

Qualitative Feedback

"For the first time, I feel like I understand what's happening with my options."

— Beta user feedback

"The AI score stopped me from making a stupid trade. It probably saved me $3K."

— User interview, post-launch

What I Learned

1. AI Trust Requires Transparency

Users don't trust "magic." Showing the reasoning process was more important than the conclusion itself.

2. Constraint Breeds Creativity

The requirement to avoid financial advice (regulatory) pushed me to design educational tools that were more effective than direct recommendations.

3. Speed = Trust in Fintech

Fixing the chart lag had an outsized impact on perceived credibility; sometimes interaction design is as important as information design.